Powering Growth in Direct Sales with Smarter Payments

WRITTEN BY

Jason Kumpf

Citcon

CRO & Payments Consultant

Date

Subscribe to our interesting updates

SHARE ON

The direct sales industry is built on relationships, agility, and trust. Whether it’s a product demo in someone’s living room, a livestream sales event, or a mobile checkout at a conference, direct sellers rely on fast, reliable payments to keep momentum going. Yet, payments are often one of the biggest obstacles standing in the way of growth.

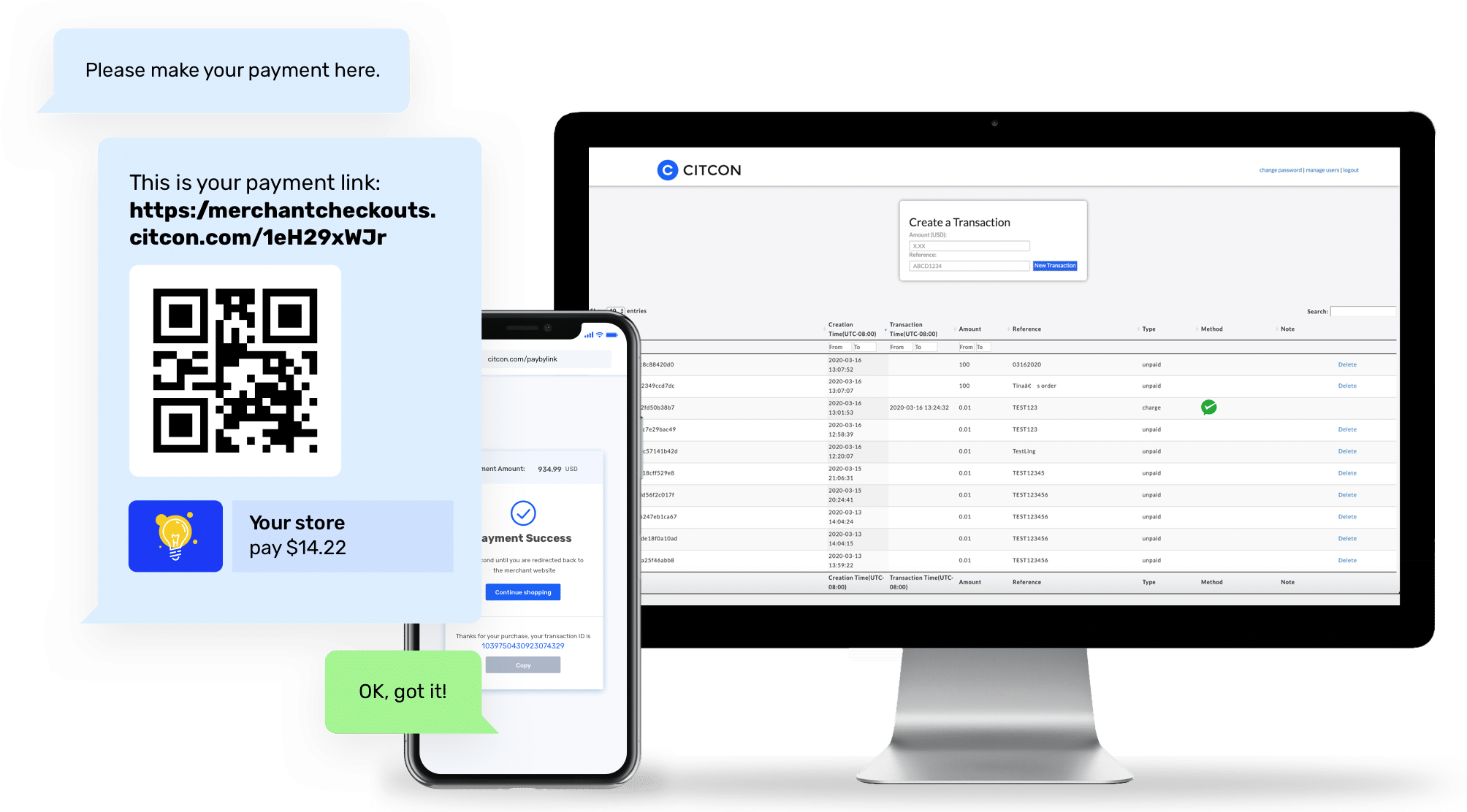

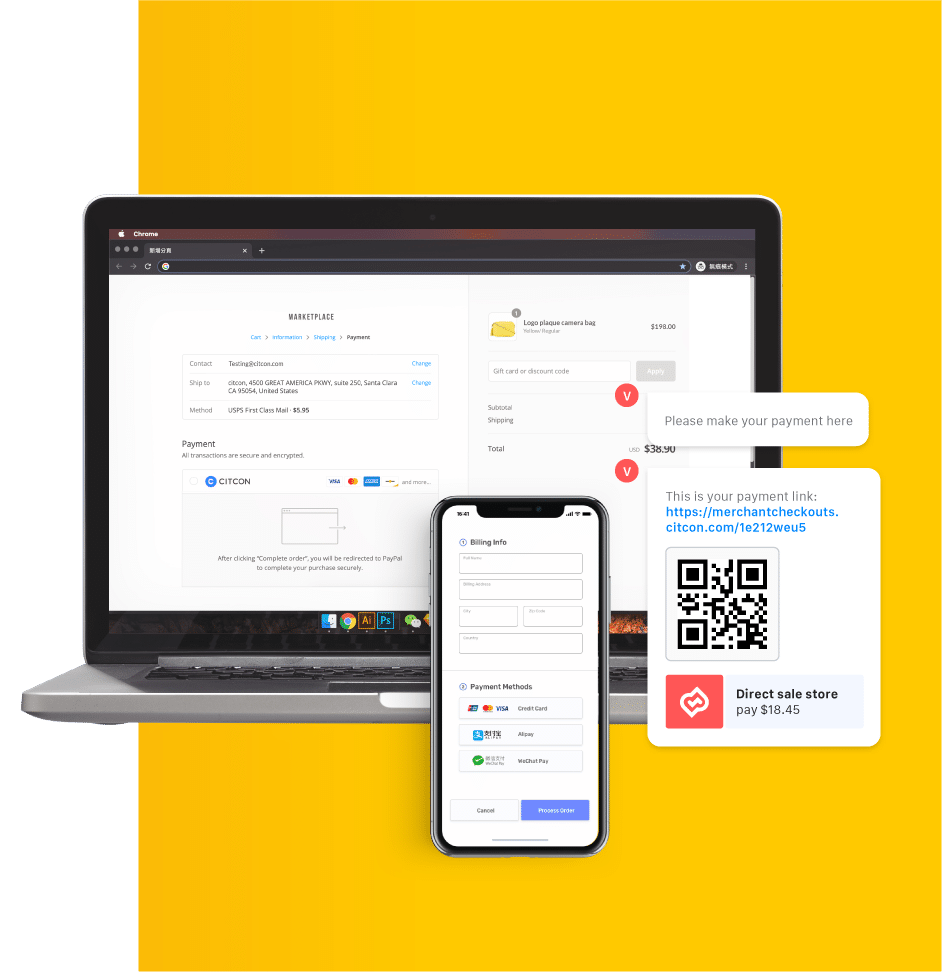

For organizations scaling across borders or managing thousands of distributors, payment systems can either accelerate success or drag the business down. Citcon provides a modern, global payments solution designed to help direct sales companies simplify complexity, empower distributors, and unlock revenue growth.

The Hidden Payment Roadblocks in Direct Sales

Direct sellers face payment challenges that go beyond what traditional retail encounters. Consider these hurdles:

- Multi-Channel Transactions

Today’s direct sales aren’t confined to a single channel. In fact, over 74% of U.S. direct sellers use social media to sell products (DSA data). Orders can come from personal events, livestreams, or mobile apps—yet many payment platforms aren’t equipped to handle this variety across regions and currencies. - Recurring Purchases & Autoship

Repeat orders and subscription-style programs are the lifeblood of direct sales. Industry reports show that over 60% of sales volume comes from repeat customers. But failed payments due to expired cards or insufficient funds can cause churn that costs companies millions each year. - Distributor Payouts & Retention

Timely payouts aren’t just financial—they’re motivational. According to the World Federation of Direct Selling Associations (WFDSA), direct selling supports over 128 million distributors worldwide. When commissions are delayed or unclear, sellers disengage. On the other hand, businesses that provide fast, transparent payouts see higher retention and performance. - Fraud & Chargebacks

Return rates and chargebacks in direct selling can be higher than average retail. A single chargeback can cost a business more than $25 in fees on top of lost revenue. Without proactive fraud detection and dispute management, margins quickly erode. - Global Expansion Hurdles

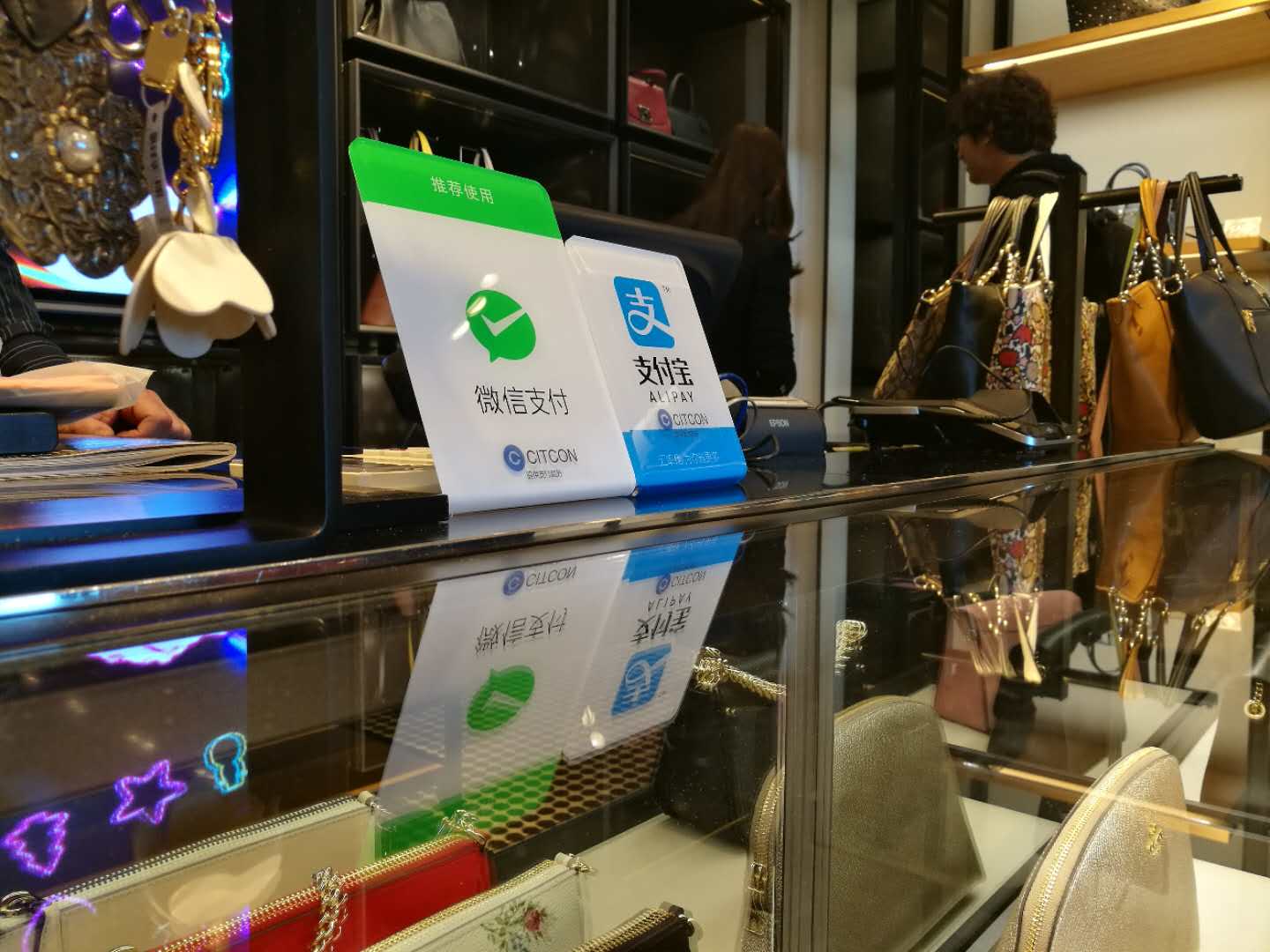

Payment preferences differ widely. While cards dominate in the U.S., over 80% of e-commerce in Asia runs on mobile wallets and local payment methods. For companies expanding abroad, not offering the right local option means walking away from potential sales.

What Direct Sellers Need from a Payment Strategy

To scale successfully, direct sales organizations require a payment framework that goes beyond basic transactions. The right system should:

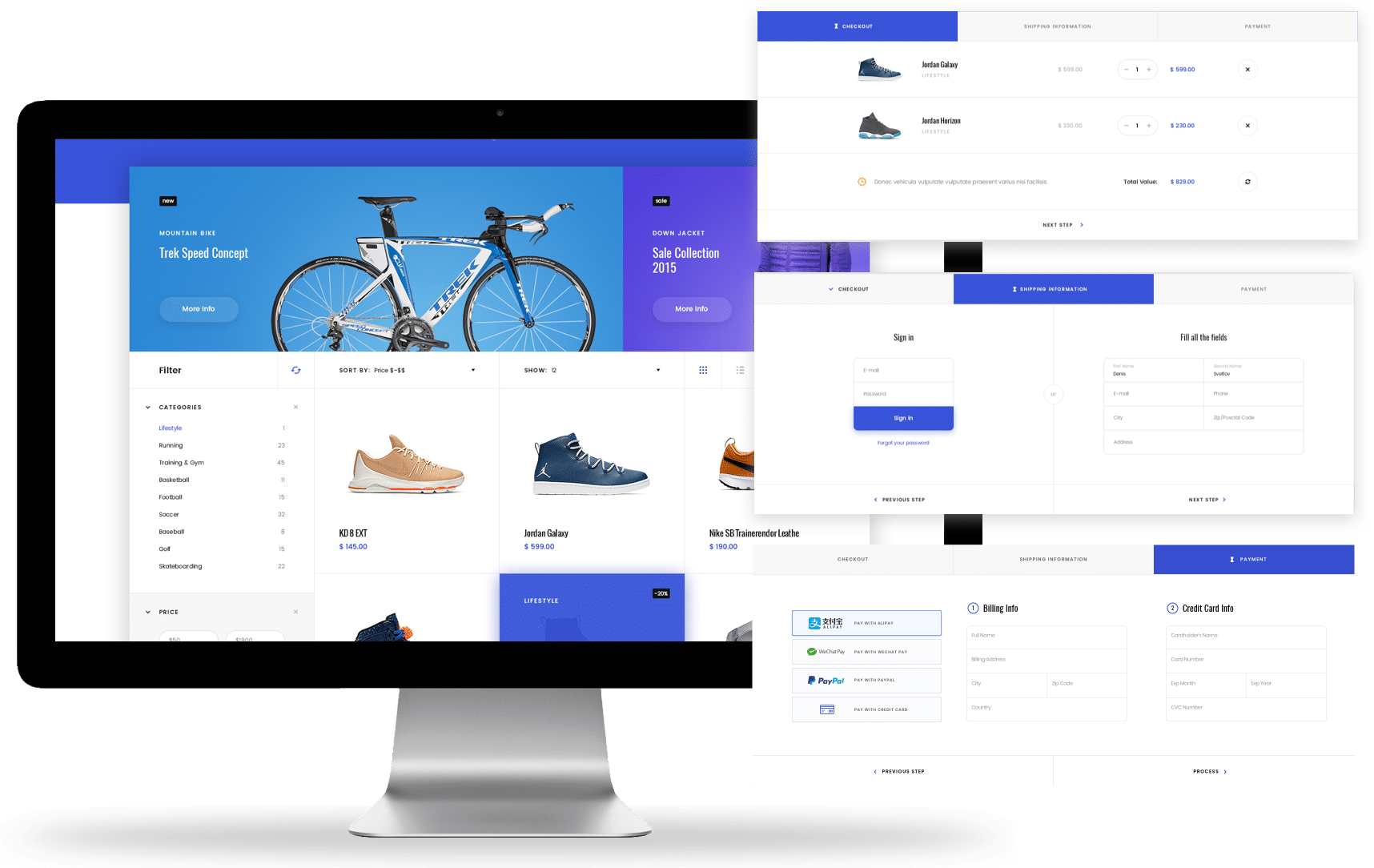

- Support omnichannel acceptance, ensuring customers can pay how and where they want.

- Provide subscription-ready tools to recover failed transactions automatically and safeguard recurring revenue.

- Offer real-time distributor payouts and detailed dashboards to build trust and loyalty.

- Integrate advanced fraud prevention to reduce disputes and chargeback fees.

- Scale with cross-border compliance, currency conversion, and local payment acceptance built in.

How Citcon Powers Direct Sales Success

Citcon’s all-in-one global payments platform was designed to meet the unique needs of direct selling organizations. Here’s how we help:

- Global Reach, Local Trust

Accept payments in 100+ currencies and support leading wallets like Alipay, WeChat Pay, PayPal, and dozens of regional options. This makes it easier for customers worldwide to buy, reducing cart abandonment. - Reliable Recurring Revenue

Our recurring billing system handles card updates, payment retries, and subscription continuity, ensuring that your autoship programs run without disruption. - Faster, Transparent Distributor Payouts

With Citcon, businesses can pay out commissions faster, often in real time, giving distributors visibility into their earnings through dashboards and reports. This not only boosts motivation but also improves retention across global teams. - Built-In Fraud Protection

Citcon includes intelligent fraud detection and dispute management to minimize chargeback costs and protect your bottom line. - Future-Ready Scalability

Whether you’re entering a new market or adding sales channels, Citcon’s platform grows with you, ensuring payments never become a roadblock.

Why Payments Should Be Viewed as a Growth Lever

Payments are more than a back-office process—they’re a direct driver of business performance. By optimizing their payment systems, direct sales organizations can achieve:

- Higher retention rates thanks to seamless recurring billing and reduced payment failures.

- Stronger distributor loyalty with faster, transparent payouts.

- Improved margins by reducing fraud losses and chargeback fees.

- Global growth potential through support of local currencies and payment methods.

- Better cash flow visibility with real-time insights and analytics.

Take the Next Step

The direct sales industry is evolving quickly, and businesses that modernize their payment strategies will have a competitive edge. With Citcon, payments become more than just a transaction—they become a tool for growth, retention, and expansion.

Ready to unlock the full potential of your direct sales organization? Contact Citcon today to learn how we can help simplify, scale, and transform your payments strategy.

.png)